Match the return and risk of a broad market index. Over the long term active management paid off most for small-cap mid-cap foreign stocks and intermediate-term bond funds which performed better than index funds and were more likely to stay open.

:max_bytes(150000):strip_icc()/HedgeFunds1_2-ba32326aefc04831be6a64313aeb5385.png)

Hedge Funds Higher Returns Or Just High Fees

Weve also spoken with investment managers who think that ETFs low-cost often passively managed funds designed to track a single asset class like for example the SP 500 will make the.

. Defining a Portfolio 3 Go Manager Fullscreen Back BMC KNOWLEDGE CH ECK A passive fund manager would be most likely. Passive funds now have 253 percent of the market in total bond funds also up a full percentage point from June 2018. Hedge funds are most likely to.

Active investments will continue to dominate with 60. Passive or index fund management is typically where the portfolio is designed to parallel the returns of a particular market index or benchmark as closely as possible. 2png - Portfolio Management.

2png - Portfolio Management. Passive investments will make up only 25 of that total. Active funds and passive funds.

A Passive Fund Manager Would Be Most Likely By Bio_Kenna66 19 Apr 2022 Post a Comment A greater passive share will likely create greater mispricings and more opportunities to generate alpha for active mana. In 2019 alone 1682 billion poured into passive US. A passive strategy does not have a management team making investment decisions and can be structured as an exchange-traded fund ETF a mutual fund or a unit investment trust.

It fails to consider the price relative to earnings or other fundamentals that drive value. A- Research the stocks in the benchmakrs portfolio extensively so as to align with it. A- Research the stocks in the benchmakrs portfolio extensively so as to align with it.

Equity funds according to fund tracker Morningstar. B Employs an active management style. Increasing the hurdle rate for a hedge fund manager will usually lead to a total fees that are.

C Has an aggressive growth objective. Course Title INVESTMENT FIN 600. Passive vehicles lead in the 116 trillion US.

A passive strategy does not have a management team making investment decisions and can be structured as an exchange-traded fund ETF a mutual fund or a unit investment trust UIT. A- Research the stocks in 1 answer below. Despite the many death notices that have been written active fund management is very much alive and kicking.

There are two main camps when it comes to fund management. C- Beat the Benchmark Index performance by achivieng a higher return. It invests in either growth stocks or.

Most mutual fund managers and advisors invest with an active approach. A strictly passive portfolio manager is most likely to. School UAEU College of Business and Economics.

A passive fund manager would be most likely to do which of the following. Passive or index fund management is typically where the portfolio is designed to parallel the returns of a particular market index or. Who are the experts.

A passive fund manager would be most likely to do which of the following. B- Align with both the market and individual funds by using competitive information. The performance of a passive fund should mirror the index its tracking which means the fund will share the ups and downs of the index.

Have a portfolio that matches a particular index or sector. Passive fund managers make no active decisions potentially resulting in less trading which reduces fund expenses and potential taxable distributions to shareholders. Credit rating agencies are best described as providing.

A fund manager is tasked with outperforming an African equity index. B- Align with both the market and individual funds by using competitive information. Increasing the hurdle rate for a hedge fund manager will usually lead to a.

Tactical asset allocation managers actively manage their portfolios switching the percentage of holding in each asset category according to the performance of the asset class. D Employs a passive management style. The profile of an actively managed mutual fund hypothetical reads as follows.

Defining a Portfolio 3 Go. According to PWC by 2025 the overall global assets under management AUM are expected to grow by 31 to US 1454 trillion. The fund invests primarily in common stocks of domestic and foreign issuers.

75K x 65 x 30 365 4006 8. A passive fund manager would be most likely to do which of the following. ABC fund seeks capital appreciation.

C- Beat the Benchmark Index performance by achivieng a higher return. Data from research firm Morningstar show that among index funds and ETFs the average expense ratio stands at 069 percent. Furthermore on average any excess expected return generated by.

So last years winning fund will likely have a difficult time staying on top for long. But when it comes to active versus passive investing which is the best investing strategy may be less. Even in passive investing thoughtful manager selection can improve the likelihood of positive investment outcomes according to Morningstar.

Impose capital lock-up periods. Passive Managers will most likely. That compares with 121 percent for actively managed funds.

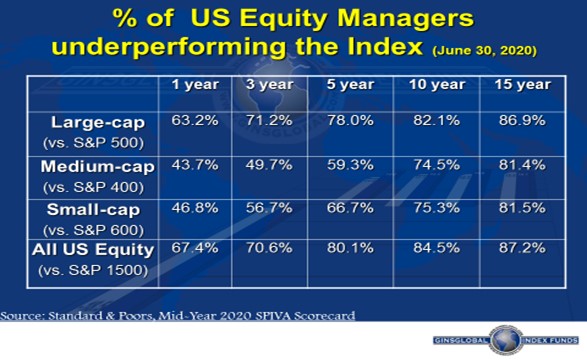

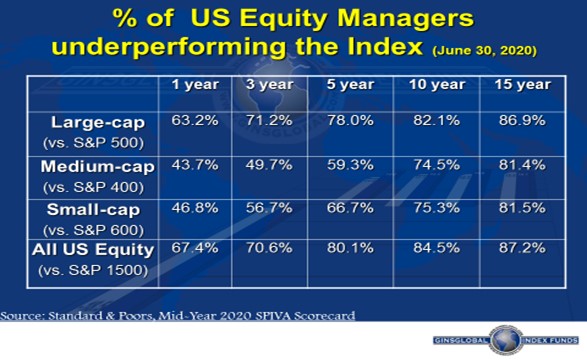

80 Of Us Fund Managers Underperform S P 500 Over 5 Years Ginsglobal

7 Reasons Why Hiring A Property Management Company Will Put More Money In Your Pocket Real Estate Management Real Estate Investing Rental Property Property Management Marketing

Fund Managers Rarely Outperform The Market For Long The Economist

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)

0 Comments